- Home

- Our Initiatives

- Nature, Climate, Economy

- Conservation Financing for Marine Protected Areas in Sri Lanka

Sri Lanka’s current economic climate poses multiple threats to the existence of Protected Areas (PAs). Fiscal austerity and debt restructuring has placed significant pressure on public finance. Additionally, apart from the threat of climate change, extractive ventures such as aquaculture have taken root in conservation sites, risking long-term ecological benefits in exchange for short-term economic relief. In Sri Lanka, conservation sites are operational. However, in the face of such uncertainty, sites could stand to benefit from unlocking innovative and long-term sources of finance.

Unlocking innovative financial solutions is only possible once conservation and financing stakeholders are on the same page regarding the issues, objectives, and outcomes of conservation. While financiers may be aware of the opportunity, the lack of awareness and knowledge on science-based conservation metrics too limits the attention given to this space.

The Centre for a Smart Future partnered with the Blue Resources Trust on a research and advocacy project to advance innovating financing for sustainable marine conservation in Sri Lanka, under a project funded by the Oceans 5 consortium.

As Sri Lanka slowly emerges out of a debilitating economic crisis, recovery must be anchored to considerations of natural capital and environmental conservation. A green and sustainable growth path must be a priority. Yet, many signs indicate that the opposite may be followed. In a bid to regain ‘lost’ growth, environmental compromises are likely to be made, and development may come at the expense of natural habitat preservation. Moreover, the acute fiscal crisis and the ongoing austerity measures imposed under a debt restructuring programme mean that resources for conservation become even scarcer than they were before.

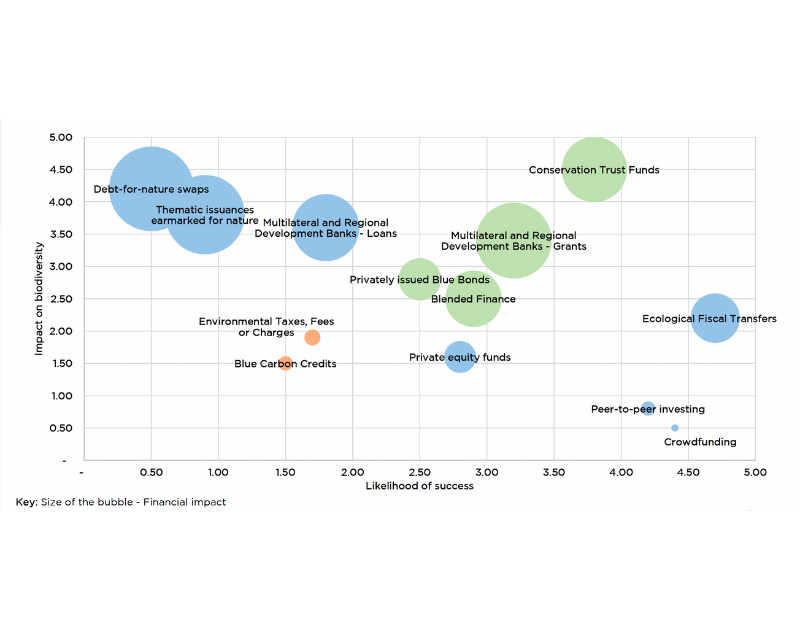

Yet, there is a distinct opportunity to ‘build forward differently’, rather than just ‘build back better’. Conserving nature, and anchoring progress to natural capital, can attract new sources of responsible finance that are now increasingly becoming available globally. So, for Sri Lanka too, innovative financial mechanisms offer a great opportunity. From small-scale grants for sustainable start-ups to national-level programmes such as debt-for-nature swaps (DFNS), these mechanisms can supplement current funding and leverage new forms of capital that are at the nexus of nature and finance. Sustainable finance is now estimated to be a US$ 37.8 trillion industry. 35.9% of global assets under management are considered to be in the sustainable investments-only space . In the marine space alone, countries like Ecuador, Belize, and Barbados have raised a total of US$ 1.3 billion in blue bonds since 2018.

There is an inherent distrust of financial instruments among the environmental community, with fears around the loss of nature sovereignty and the impacts that mechanisms would have on indigenous use. Many top-down approaches to conservation investment fail to empower local communities in financing initiatives. Alongside the rise of payment for eco-system services and market-based approaches, there are concerns about commodification of nature and the prioritization of economic benefits, and the exclusion of local communities from accessing those benefits.

CSF has been working on crafting a framework for a Conservation Investment Plan, in collaboration with Blue Resources Trust, dedicated to the sustainable financing of the Vidathalathivu Nature Reserve (VNR). Through this initiative, we have examined some of the requirements needed to attract financing solutions for long term sustainability, including analysis of stakeholders of an MPA, and the uses, users and tensions. We commenced working with the Department of Wildlife Conservation (DWC), by building their knowledge and technical capacity around conservation finance techniques, planning methodologies, and stakeholder considerations.

The overall project has two components – firstly, helping advance the knowledge and understanding of available sustainable marine conservation financing and secondly, demonstrate how these can be practically deployed in example sites in the country (starting with VNR).

For open and easy access for all stakeholders, we will post here all publications, tools and methodologies guides, and research reports. For more information write to [email protected]

1. Guidebook on Conservation Financing: Fundamentals of Conservation Finance for (Marine) Protected Areas of Sri Lanka

Emphasising the critical connection between conservation goals and financial planning, this Guidebook provides a comprehensive roadmap and set of steps to understanding and implementing Conservation Finance for Marine Protected Areas in Sri Lanka. It is designed to empower conservation managers to manage and deploy funds effectively, emphasising the diverse ecological, economic and social values that underpin effective financing strategies needed to safeguard our natural heritage for future generations.

2. A Stakeholder Mapping and Analysis for Conservation Finance: The Case of the Vidaththalthivu Nature Reserve

This document explores the complex network of stakeholders influencing the management and conservation of the Vidithalathivu Nature Reserve (VNR). Through the stakeholder mapping and analysis exercises employed here, we set out to understand the diverse interests, actions, relationships, and dynamics that influence conservation endeavors in and around the MPA. Our aim is to address the oversight in conservation financial planning, and shed light on community perceptions, land use changes, and broader contextual impacts essential for effective and inclusive conservation finance.

3. An Outline for Conservation Finance in Sri Lanka’s Marine Protected Areas: The Case of the Vidaththalthivu Nature Reserve

Centred on the Vidithalathivu Nature Reserve, this report examines sustainable finance strategies to support wildlife conservation for Marine Protected Areas (MPAs) in Sri Lanka. Based on the Department of Wildlife Conservation’s (DWC) current operations and new management plans, this report analyzes on-the-ground challenges, highlights the benefits of strategic financial planning, and underscores the importance of holistic, and inclusive approaches to conservation finance, such as a Conservation Investment Plan, and emphasizes community involvement for improved conservation outcomes.

4. Flashcards Explaining Conservation Finance Concepts, Approaches, and Examples

A great tool to accompany any training session, briefing, or knowledge engagement on conservation finance are these information flashcards each covering a key concept, area, or topic in conservation finance. This flashcard deck accompanies our Guidebook, and contains short takeaways to help introduce readers who might be yet unfamiliar, to some of the key aspects in conservation finance. These flashcards can useful for group activities, training modules, and revision exercises to help reinforce conservation finance learnings. Click each title below to download each flashcard.

Introduction to conservation finance

Understanding economic value in conservation finance

Recognising and analysing stakeholders in conservation

Challenges in conservation finance

Articles and reports on marine conservation financing