- Home

- Knowledge Insights

- Changing How We Think About Economic Growth and Nature

Earlier this year, Sri Lanka’s census and statistics department released a new version of the country’s Gross Domestic Product (GDP) calculation. The existing National Accounts had been ‘rebased’. from the year 2010 to the year 2015. In explaining the re-basing,. the department noted that “a number of improvements” to GDP compilation was done, the first item on the list was ‘Inclusion of generated value addition from the reclaimed land of Colombo Port city project’. It further went on to note that, “The GDP levels increased significantly over the period of 2015-2018 as a result of the[…] reclaimed land of Colombo port city project”, and “by the year 2019, the land reclamation had been completed and as a result […] the GDP growth rate was lower when compared to 2018”. The fact that the creation of a 269-hectare artificial land parcel attached to the capital, with sand extracted from nature, materially changed the country’s GDP base was startling. It triggered within us, again, a growing discontent we have felt for a while on how we think about economic growth and an unease with how we assess progress.

For some years now, stemming from a love for the natural world, interest in biodiversity, and enthusiasm for photography, we had begun to think about critical issues with our current approach to economic growth. To be sure, neither of us are environmental scientists, ecologists, nor experts on nature. But we realised that in our own professional worlds of economics and finance in Sri Lanka, there was little mainstream understanding of the threats faced by the natural world and their knock-on effects for our prosperity, health, and well-being. Particularly, there was little appreciation for the value of nature – for instance the emerging agenda of the valuation of natural capital.

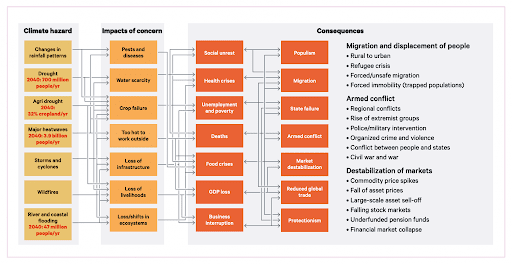

According to the Convention on Biological Diversity,. “Natural Capital can be defined as the world’s stocks of natural assets which include geology, soil, air, water and all living things. It is from this Natural Capital that humans derive a wide range of services, often called ecosystem services, which make human life possible.” Yet, our economic models, conceptualizations of what constitutes desirable economic growth, and financial valuations of projects, are skewed in a narrower direction, one that has increasingly become out of touch with the realities of climate change and biodiversity loss, and the cascading risks to people and livelihoods. Moreover, new research. is showing that due to these cascading risks increasingly, they affect more than just people’s livelihoods – they risk social stability and security (see Figure 1).

In fact, not only have our approaches to economics and finance not considered nature – whether it is in mainstream economic policy, banking practices or investment strategies – they have knowingly or unknowingly contributed to a widespread destruction of nature. Whether it is ill-advised public infrastructure programmes that cause irreversible environmental damage despite favourable Environmental Impact Assessments being granted, or whether it is narrow-minded agriculture, industrial or tourism projects by the private sector, examples of investment decisions being taken without considering nature are plentiful in Sri Lanka today. These concerns – certainly not new, but perhaps relatively underexplored in our fraternity – led us to this point. We must put forward a new narrative for economic growth and finance, that considers nature as internal, rather than external.

Figure 1: Cascading and systemic risks from climate change and biodiversity loss

Source: Chatham House (2021), ‘Climate change risk assessment 2021’

Economists have historically done a poor job of valuing natural capital. There is now growing recognition that the world of economics and finance need to do better at accounting for natural assets that tend to be ‘invisible’ and don’t have a ‘market price’. One obstacle is the dominance of neat and convenient, but wholly inadequate, metrics of growth and prosperity like Gross Domestic Product (GDP). A future article will explore in more detail theorigins of GDP. as a measure, and its discontents. But for now, suffice to say, GDP came to the fore against the backdrop of the Great Depression and World War II, following the work by Russian economist Simon Kuznets in 1937. Even Kuznets recognized as far back as then. that “The welfare of a nation can scarcely be inferred from a measure of national income”.

Undoubtedly, economic growth over the last several decades has raised living standards around the world. However, modern economies have lost sight of the fact that this standard metric of economic growth, merely measures the size of a nation’s economy and does not reflect a nation’s welfare and holistic progress. Yet, policymakers and economists often treat GDP (or GDP per capita) as this neat, all-encompassing metric to signify a nation’s development, combining its economic prosperity and societal well-being. As a result, policies that result in pure GDP growth are perceived and assumed to be beneficial for society.

While a statistic such as GDP does a good job of showing the value of goods and services exchanged in markets, it does not reflect the dependency of the economy on nature, nor its impacts on nature, such as the deterioration of water quality or the loss of a forest, to achieve that GDP. GDP doesn’t account for all the natural assets that must be depreciated to get that growth. The growing concern is that this depreciation of natural assets to achieve that GDP, has been increasing over the years and we have not factored it in our metrics.

According to a UNEP report. published a year ago, ‘Making Peace with Nature’, the global economy has grown nearly fivefold over the last 50 years, largely due to a tripling in extraction of natural resources and energy that has fuelled growth in production and consumption. Over the same time, the world population has increased by a factor of two, to 7.8 billion people, and though on average prosperity has also doubled, about 1.3 billion people still live in poverty and some 700 million are hungry. The loss of biodiversity and ecosystem integrity, together with climate change and pollution is likely to undermine efforts on 80% of the Sustainable Development Goal (SDG) targets. So, we must begin to consider richer, more holistic frameworks that put forward new ways of valuing our economies, that incorporate our natural resources and ecosystems.

“What gets measured, gets managed” is a popular adage in business, and is relevant here too. For over a century, we have been ‘measuring’ GDP and thus all policies are targeted towards its ‘management’. But since nature was never measured or valued, it was never managed, and hence we pay the price today of a degraded planet. We believe we need to make fundamental changes to how we value growth and prosperity today, otherwise we could be faced with unprecedented and irreversible ecological and socio-economic challenges.

While we are by no means the first to advocate on this, certainly in Sri Lanka the debate seems to be stuck in old paradigms. The narrow understandings of economic growth in mainstream debate, and the policy and political messaging around GDP, influences economic policymaking and business decision making. So, a narrow and outdated measure is in turn sending a misleading signal to policymakers and businesses on how they should chart the future course of the economy or their business.

A basic study of the technical construction of GDP in Sri Lanka (via the Department of Census and Statistics) helps you understand that GDP does not contain full information that we need to inform economic trajectories and business models today. Why is this important for Sri Lanka? While Sri Lanka has a remarkably high level of species endemism, current and emerging threats to natural environments are threatening future prosperity. We are one of the most vulnerable countries to climate change, ranking 6th on the Climate Risk Index.. The country is at a crossroads with only

one sensible choice – a growth trajectory that progresses human development while easing pressure on nature.

There are no shortages of new approaches today – it’s time we begin meaningful and focussed conversations on how these can be applied in Sri Lanka. While there are some experimental approaches by individual countries (for example, Bhutan’s Gross National Happiness (GNH) Index or India’s Ease of Living Index), there are other approaches that are more global and multilateral in nature, and so have a greater chance of acceptance and adoption in Sri Lanka. For instance, the latest iteration of the Human Development Index (HDI) – the ‘Planetary pressures-adjusted Human Development Index’ (PHDI) – adjusts the HDI for planetary pressures in the Anthropocene. The PHDI discounts the HDI for pressures on the planet to reflect a concern for intergenerational inequality, like the inequality-adjusted HDI adjustment which is motivated by a concern for intra-generational inequality. The PHDI is the level of human development adjusted by carbon dioxide emissions per person (production-based) and material footprint per capita to account for the excessive human pressure on the planet. In an ideal scenario where there are no pressures on the planet, the PHDI equals the HDI. However, as pressures increase, the PHDI falls below the HDI. In this sense, the PHDI measures the level of human development when planetary pressures are considered.

Perhaps most significantly is the new framework adopted by the UN Statistical Commission – the System of Environmental Economic Accounting – Ecosystem Accounting (SEEA EA). This marks a major step forward in going beyond GDP. The measure would ensure that natural capital – forests, wetlands, and other ecosystems – are recognized in economic reporting. The new framework recognizes that ecosystems deliver important services that generate benefits for people. For example, forests play a role in providing communities with clean water, serving as natural water filters with trees, plants, and other characteristics, such as soil depth, that help absorb nutrient pollution like nitrogen and phosphorus before it can flow into streams, rivers and lakes. More than 34 countries are compiling ecosystem accounts on an experimental basis. With the adoption of the new accounting recommendations, many more countries are expected to begin implementing the system. The UN does acknowledge, though, that a significant number of countries will require assistance and additional resources for statistical data collection.

Through the ‘Re:Value’ initiative of the Centre for a Smart Future, we aim to shed light on these underexplored spaces, and begin conversations around how Sri Lanka can better account for nature, and influence business strategies and public policies. We aim to influence how economics is taught (to include material on natural capital), to train finance professionals to better value natural assets (and risks of their loss) and bring the economics and business fraternity closer to conservationists and environmental scientists in our country.

Already, CSF led the way in bringing to Sri Lanka new frameworks on climate disclosure reporting,. together with the Climate Disclosure Standards Board and the Colombo Stock Exchange in January 2022. This is the first time that Sri Lankan corporates were introduced to the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and accounting of climate risks. This is especially poignant, given that an August 2022 study on the Western Province. (where over 45% of national output is generated) noted “significant financial and political risks related to climate change”.

This article, and indeed the broader ‘Re:Value’ series, is not meant to be a definitive guide on how to adopt the new frameworks referred to, rather they are meant to begin a conversation – about moving forward from GDP to other more holistic metrics, about doing better at valuing natural capital, and about showcasing examples of how other countries and communities, as well as companies in Sri Lanka and abroad, are considering nature in their investment decisions and development strategies. A conversation that for too long economists as well as finance and business professionals in Sri Lanka in particular, have ignored, or simply not thought enough about, or relegated to the box of ‘Corporate Social Responsibility projects’.

We are trying to bring the two worlds of economics and ecology closer together in Sri Lanka. As the quote popularly attributed to ‘ecological economist’ Herman Daly. suggests, we want to proliferate the idea that ‘the economy is in fact a wholly owned subsidiary of the environment, not the other way around’. This is something that is already happening very actively in many countries and was accelerated by the pandemic. Our objective is to use this platform to spur those conversations and bring like-minded people together, to inform and inspire changes to our public policy and business approaches. This article – and the series ‘Re:Value’ it is part of – is meant to serve as a lighthouse to others who want to think differently, to join us in this journey – a journey of learning and discovery that we are also on.

—

The authors thank Arpana Giritharan,. for her valuable inputs during a review of this article.

Anushka Wijesinha is Co-founder of CSF. He is an economist by training and has a passion for nature photography and conservation. He serves on the Boards of Seylan Bank PLC, HNB Finance PLC, and Fairfirst Insurance, as well as the Environmental Foundation Ltd. Anushka is a member of the Central Bank’s Stakeholder Engagement Committee. He was a member of the World Economic Forum’s Global Future Council on Innovation Ecosystems.

Sohan Patrick is Business Director at MAS Capital (Pvt) Ltd, a Sri Lankan apparel multinational. He is a Visiting Fellow at CSF, working on the ‘Re:Value’ initiative. He is a finance professional and an economist with a passion for wildlife and conservation. He is a member of the Economy of Francesco, working with the Vatican on economic and social reforms. He was the former Vice President of the Sri Lanka Tennis Association (SLTA) and currently serves as a National Tennis Selector.